The Direxion Daily Gold Miners Bear 3X Shares is the highest leveraged of the bearish ETF's with the Direxion Daily Junior Gold Miners Index Bear 3X Shares filling the same niche for the little guys.

Gold is at $1287.50 down $7.10, the GDX is at $23.32 off 7 cents, DUST $25.80 up 23 cents and GDXJ down 23 cents at $34.58.

From Investing.com:

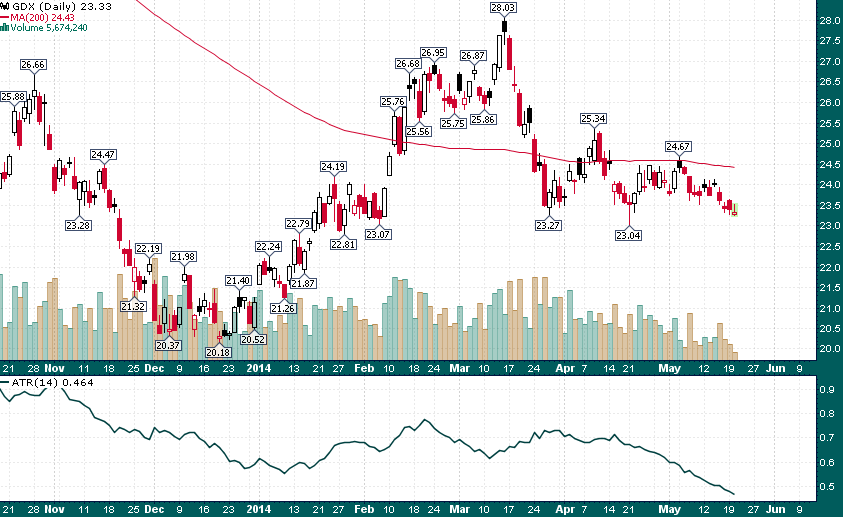

After experiencing a year of extraordinary volatility during 2013 the gold miners (Market Vectors Gold Miners ETF (ARCA:GDX)) have turned downright dormant during the past few weeks:

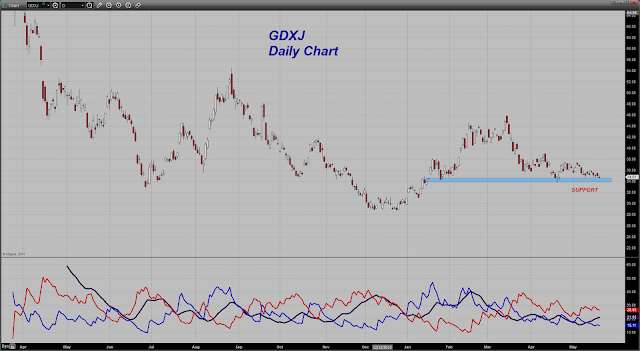

For 9 consecutive trading sessions the GDX has traded within less than a 2% intraday range and for the past two months GDX has remained well contained within a 10% trading range.Here's the risk for the Junior miner ETF:

This is the lowest realized volatility on record for the Gold Miners ETF...MORE