The fact that gold is declining in the face of lower rates i.e. lower opportunity cost is quite negative for metals fanciers.

The piece below is the inverse analysis of something that FT Alphaville's Izabella Kaminska did back in December 2012, "Capping the gold price" which, were one paying attention, turned out to be remarkably profitable. More links below.

Gold futures $1260.90 and apparently on the way back to the 2013 June-December double bottoms at $1179.

Here is the Treasury's TIPS site, nominal yields are negative out to the January 2022's at 0.078 with accrued principal at 1042. The 5/8ths of 2024 are bid at 103.05 to yield 0.277 with accrued at 1011.

From Advisor Perspectives, Tuesday May 27:

For the last decade, TIPS yields and gold have had a negative 88% correlation. The logic is simple enough: since gold doesn't generate any income, falling TIPS rates reduce the opportunity cost of holding gold. We can see this play out in the charts below. In early 2008, the peak in gold was accompanied by a trough in TIPS yields, and then later in 2008, the trough in gold was accompanied by a rise in TIPS yields.

On December 10, 2012 TIPS yields bottomed at -.87%, and this began the slide in gold from $1700/oz. to just under $1250/oz. by the end of 2013. Since the beginning of the year, 10 year TIPS yields have fallen from 75bps to 32bps, yet gold prices are mostly unchanged.

Gold is down about 2% today, falling under $1270/oz for the first time since February. In the chart below, we transform the time series chart above to a scatterplot that illustrates the relationship without regard to time. There is not a single data point in the last decade where gold is below $1290/oz. with TIPS rates at or below 35bps. The breakdown in gold could suggest that the trend toward falling TIPS yields may be set to reverse....MORE

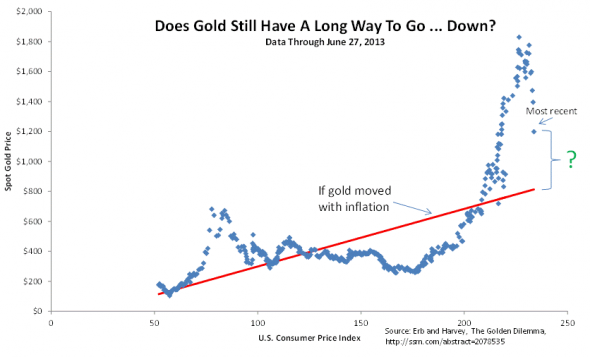

From our June 2013 post "Targeting the Bottom for Gold":

FT Alphaville's Izabella Kaminska has been remarkably restrained.

If you read the comments on some of her gold posts from 2012-2013 you'd come away with the impression she practiced some debauched puppies-in-a-blender Ilse Koch/Cruella deVil cultism.

Of course she did, from time to time, bait the gold-buggery crowd with headlines like "Bricks of gold, bits of code: the worship of things shiny and useless" but overall she was fair, almost clinical in her examination of gold and the lovers thereof.

So having watched the over $500/oz. plummet from last December she must have been tempted to sneak in one little told ya so, but she hasn't.

Me on the other hand, I'm probably not as circumspect....

Anyhoo.

In today's installment, "How low can gold go?", she, without snark, says:

...This has now led a whole bunch of people getting excited about an upcoming bottom in gold, as well its prospective speedy revival.

But on the subject of gold bottoms, some bottom talk is more compelling than others. Campbell Harvey, from Duke University, for example, has been arguing for a while that in real terms the gold price has been overvalued for some time.

So, on the basis that gold really is the inflation hedge some people think it is, its value should currently more about the … $800 mark:

But since gold doesn’t really do a good job of moving with inflation, it’s hard to say if common sense valuations will prevail. In fact, Harvey questions the entire correlation between gold and real yields, and suggests its outperformance is mostly the result of a “fear trade”....MOREThe r-squared for gold and real rates is .82 (depending on the timeframe, of course)...MUCH MORE

See also:

Barron's on Gold and Real Interest Rates