Ahead of today's delayed EIA oil numbers here's something to chew on from FT Alphaville:

Desperately seeking volatility

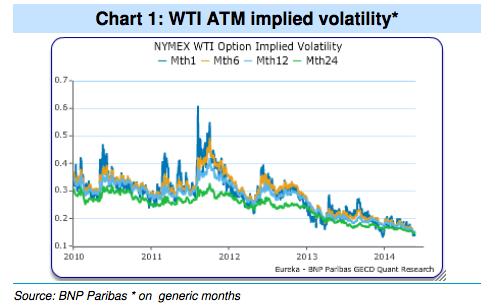

The curious case of vanishing volatility deepens, with the latest installment coming by way of the oil market.

From Harry Tchilinguirian’s team at BNP Paribas, this is apparently what the death of volatility looks like:...MUCH MORE

And here’s the explainer:

More than mid-way through the second quarter, the oil market has indeed been mostly range-bound. And despite geopolitical flare-ups in Ukraine or Libya, implied oil volatility, be it on WTI or Brent, has moved lower still from the time of our recommendation. As volatility fell over the recent months, many in the market initiated long volatility positions in the hope of mean reversion higher, only to suffer from the cost of carry associated with time decay, while volatility itself continued to erode.

Front futures (Jul.) $102.80 up 8 cents. There is a very monotonic bacwardation out to the Dec . 2016's at $86.57.

Recent Climateer Investing headlines might suggest a method to the madness but alas it's just madness:

Cramer: "Charts point to potential $25 decline in oil"

It's Quiet Out There: "600 Days Without a 3% Daily Change"

Via FinViz as close to a flatline as you are likely to see in commodities: