Mother: .....And remember, the Lord loves a working man.Summers is the ultimate technocrat "Whitey".

Navin: ........Lord loves a working man.

Father: ......And son, don't never, ever trust whitey.

-The Jerk (1979)

Following Summers leads to disaster when his façade of technocratic omnipotence meets the messiness of the real world.

In last Tuesday's "Larry Summers Says the U.S. Should Gradually Shift to More Short-Term Debt" I agreed with the Treasury's approach of a slight lengthening of maturities. Here's a different take, that it really doesn't matter so much and that in the long run we are all dead.

From FT Alphaville:

Government debt and monetary policy

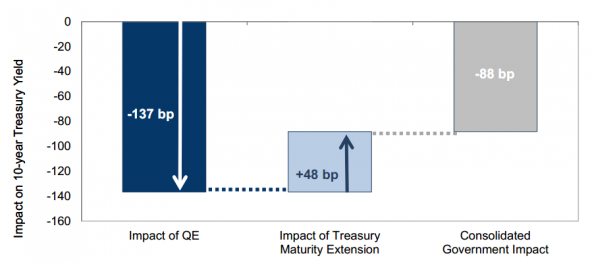

A new paper by several Harvard economists, including former Treasury Secretary Larry Summers, argues that a little more than a third of the impact of the Fed’s asset purchase programmes was “offset” by the Treasury’s decision to lengthen the maturity of its outstanding bonds:

It seems very odd that the Federal Reserve is taking actions that have the effect of substantially reducing the duration of the debt held by the public at a time when the Treasury is arguing that it is in taxpayers’ interest to extend the duration of the debt at a rapid pace. Moreover, the Federal Reserve has done so without formally acknowledging any of the considerations invoked by the Treasury. Similarly, the Treasury is taking steps that in the judgment of the Fed are contractionary, while committing itself in general to expansion of demand as a principal policy without ever addressing the concern about contractionary policy.(You can watch the full video of the paper’s presentation and discussion at the Brookings Institution here.)

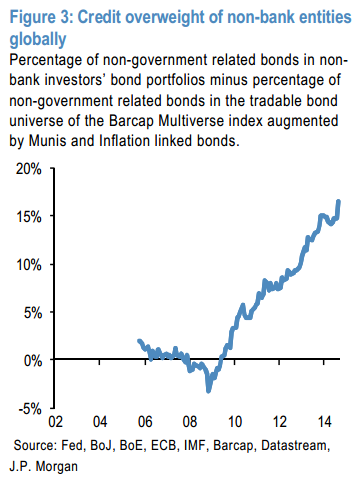

According to Summers et al, the main justification for the Fed’s bond-buying was that constricting the supply of safe assets available for people to own drives down risk-free returns, which encourage savers to “reach for yield” by making risky investments. Sure enough, credit spreads have collapsed even as dodgy borrowers have been issuing more garbage securities than ever.In their latest note, JPMorgan’s flows and liquidity team finds that non-bank investors have dramatically overweighted their bond portfolios towards risky private-sector borrowers over the past five years in an effort to pick up marginally higher returns than they could get from buying government debt:

Their explanation is that “central banks have been “soaking up” government related bonds forcing private investors to hold successively more corporate bonds.”

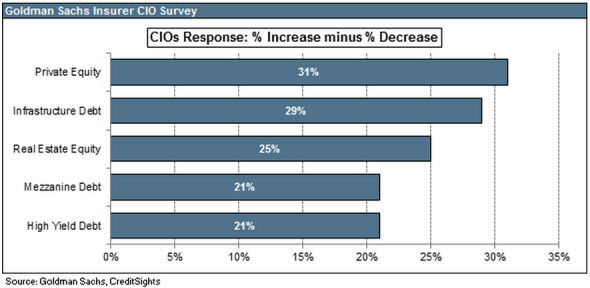

Even cautious insurers with their long-term fixed income liabilities are increasingly relying on hedge fund and private equity allocations to hit their nominal return targets. From a recent CreditSights note on the subject:

We anticipate that investment into private equity and hedge funds will become more popular throughout the Life and P&C [property and casualty] industry. The longer the low interest rate environment persists, the more insurers will find this asset class attractive…39% of CIOs suggested that they plan to increase overall risk in their portfolios. Beyond that, the table below shows the percentage of CIOs responding that they would increase exposure to an asset class minus the percentage of those saying they would decrease exposure. Private equity and mezzanine debt make it on to the the list of top 5 asset classes.

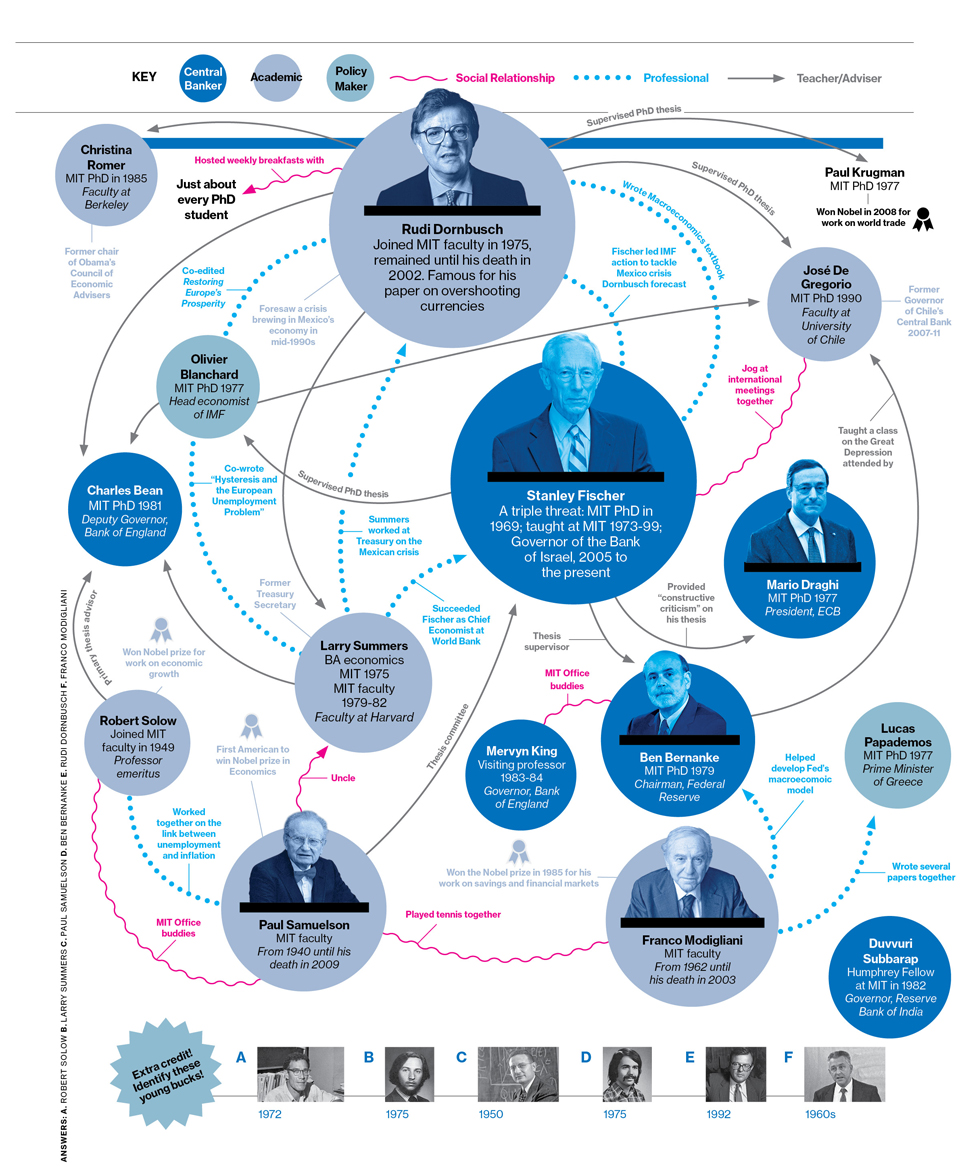

No wonder Steve Schwarzman famously thanked former Fed chairman Ben Bernanke for the help the central bank played in Blackstone’s asset-gathering. (Whether any of this helped the real economy is another matter…)On the chart of the MIT Econ mafia, Summers is southwest of Fischer and just above Samuelson:

The critique from Summers et al. is that the Fed’s balance sheet expansion (about $2.9 trillion above trend) would have been more potent if only the Treasury hadn’t gotten in the way. Of course, if the Fed were genuinely bothered it could have just bought more duration to offset the Treasury’s actions. If that weren’t enough, the Fed could have simply committed to buying as many bonds of different maturities as necessary to push the yield curve wherever it wanted.

The Fed didn’t do those things because officials there came to believe that the marginal impact had gotten too small to matter....MUCH MORE