From the International Monetary Fund's iMFdirect blog:

Investment in the euro area, and particularly private investment, has

not recovered since the onset of the global financial crisis.

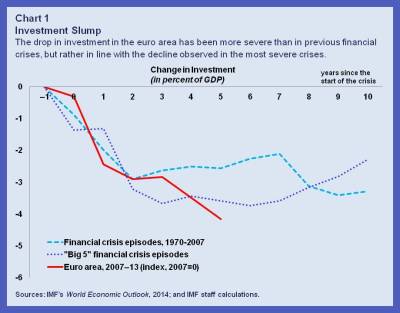

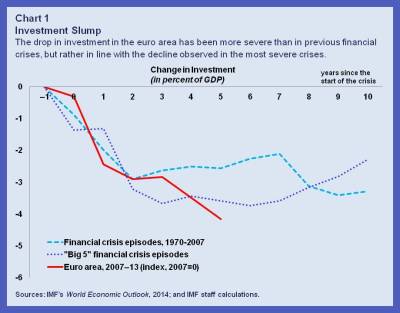

In fact, the decline in investment has been much more drastic than in

other financial crises; and is more in line with the most severe of

these crises (see Chart 1). The October 2014 World Economic Outlook

showed that many governments cut investment because their finances

became strained during the crisis. In addition, housing investment

collapsed in some countries, reflecting a natural scaling back after an

unsustainable boom. But what is holding back private non-residential

investment?

In an IMF Working Paper,

we have looked at the driving factors of private non-residential

investment in seven euro area countries – Germany, France, Spain, Italy,

Ireland, Portugal and Greece – and the euro area as a whole until 2013.

We find that low growth is definitely a big part of the story. But

crisis legacies, such as high corporate leverage, financial constraints,

and policy uncertainty are also holding back investment in some

countries.

A vicious “Catch 22”

Much of the dip in investment since the crisis can be explained by

low or negative growth. Effectively, this creates a “Catch 22”: growth

is weak partly because investment is low, but investment is low because

companies don’t have sufficient demand for their products. The shortfall

in investment dims both short- and medium-term prospects for the euro

area. Countries need higher investment to raise demand now, increase the

productive capacity of their economies, and secure permanently higher

incomes. Yet, without higher demand, firms are unwilling to invest.

This is particularly true for Spain, where changes in real GDP

explain the variation in investment well. But in many euro area

countries, investment has declined by more than suggested by the changes

in output since the beginning of the euro area debt crisis....MORE