I thought this:"...that bane of interesting narrative, that supporter of the yen, that acronym of dubious origin ..."

"This royal throne of kings, this sceptred isle...Maybe it's just me.

...This blessed plot, this earth, this realm, this England"

On the other hand, if a writer is going to channel anyone, you definitely could do worse than Richard II.

David Keohane writing for FT Alphaville:

This re-correlated world

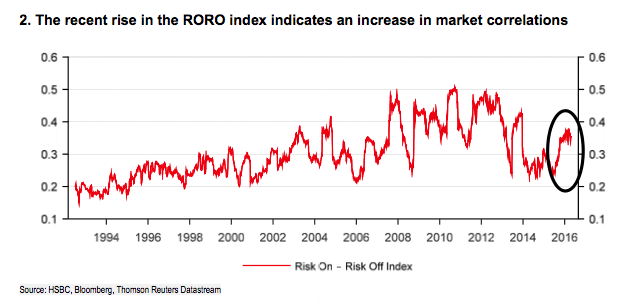

ICYMI, RoRo — or risk on/ risk off — is apparently back.

It’s not quite at peak levels but that bane of interesting narrative, that supporter of the yen, that acronym of dubious origin is getting back up there:

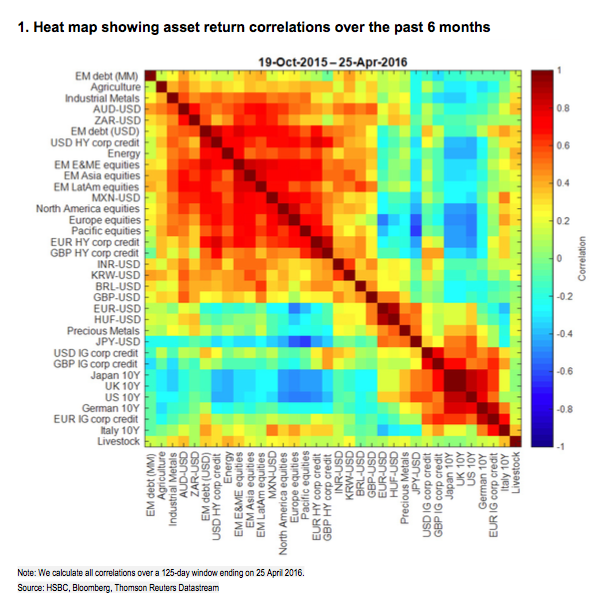

That’s from HSBC’s FX team last week as they reissued their RoRo charts and warnings. Remember, red means strong positive correlation, blue means strong negative correlation, green and yellow means correlations are heading to zero. So, as HSBC say: the RoRo ‘paradigm’ can be defined by three key features:

This is what those correlations look like now:...MUCH MORE

- “Risk-on” assets are positively correlated with each other

- “Risk-off” assets are positively correlated with each other

- “Risk-on” assets are negatively correlated with “risk-off” assets