Vol is low, not cheap

We’ve talked about how quiet the market is already.

Complacency is becoming an ever more common hit in our inboxes, and we assume not just because of herding instinct.

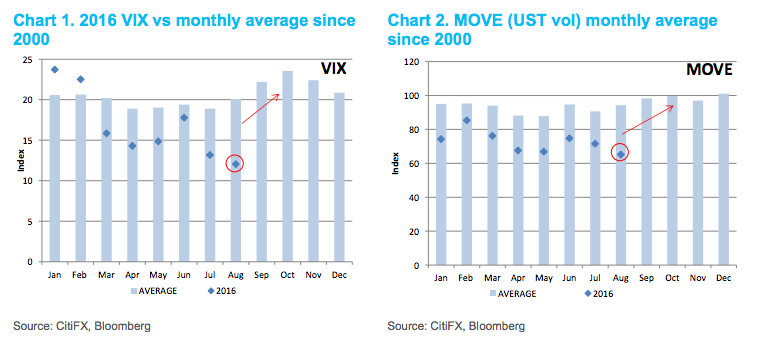

It’s also because, as we already quoted Citi: “Current vols are a strong outlier, not just compared to 2016, but against the average for all Augusts since 2000 (see charts 2, 3 below). That should give any trader pause.”

Citi noted that we had “entered the bottom of 10% range across assets… approaching lowest vol for the past 12 months across three asset classes.” For the “August monthly average over 2000-2016 period, VIX is at the lowest ever, with fixed income and FX in the bottom 10%.”See also:

The obvious, easiest to grasp, reason being that central banks underpinning the market are keeping everything on something approaching an even keel (or eery calm, if you’d prefer).

As HSBC’s FX team argued, we may be “entering a new volatility regime. Implied volatility is low despite what should have been significant shocks to the market. Implied volatility is low even though the outlook is filled with plausible risks. This suggests that it is likely to take a serious shock now in order to make the market run for cover.”

The obvious, less easy to grasp, question is whether all that complacency puts us at risk of a VaR shock. As JPM’s Flow’s & Liquidity team put it, with our emphasis:

VaR shocks do not necessarily need a fundamental trigger such as policy changes or political events. Examples of fundamental or policy triggered VaR shocks were the taper tantrum of May 2013, the Chinese devaluation of August 2015 and more recently the Brexit vote. VaR shocks can simply occur if, for example, investor positions normalize from previous extreme levels. Examples of such non-fundamental VaR episodes were those that took place in April 2013 in the JGB market or in April 2015 in the Bund market.Yup, and per JPM, low vol is a condition associated with VaR shocks as it “induces investors, most of whom employ some type of volatility-based risk management framework, to increase the notional size of their positions as volatility collapses....MUCH MORE

"How a Low VIX Can Remain an Expensive Hedge"